Sales tax automation

Automate sales tax compliance

Monitor nexus across all 50 states

Register and file automatically

Integrates with Stripe, Shopify, QuickBooks

Trusted by top e-commerce & SaaS founders

Effortless sales tax compliance

Afternoon makes it easy to monitor exposure, register, and file sales tax in all US states.

Monitor exposure

Connect your billing and HR system to monitor your exposure in real-time.

Nexus study

Our tax experts will determine which states you have a tax obligation in, and which states you need to register in.

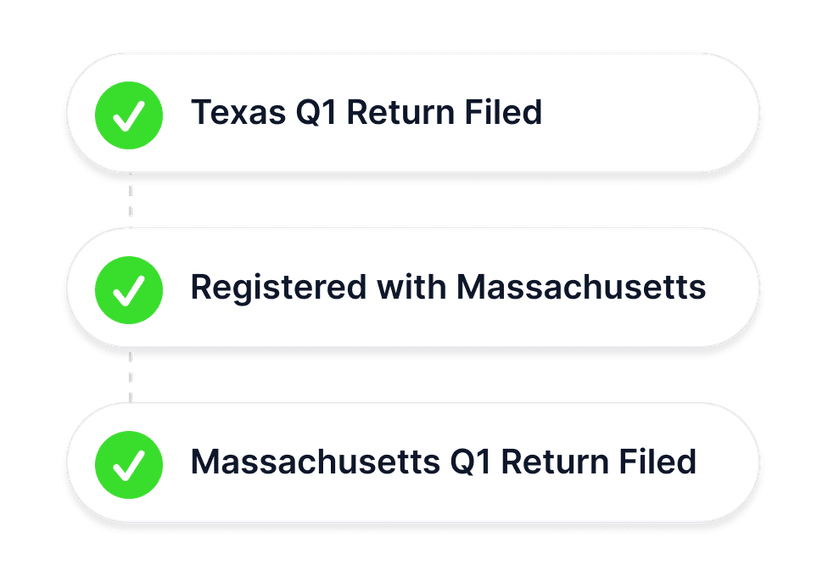

Register

Register in any US state with a single click. Afternoon will register you in all states where you have a tax obligation.

File and remit sales tax automatically

We will file and remit sales taxes in all states automatically on your behalf.

Seamless integration with the tools you already use.

We switched over from Avalara, and we couldn't be happier. Avalara's communication was so slow, and we were constantly chasing them for answers. Afternoon deregistered our business in states we were no longer selling in, which Avalara refused to do and kept charging us for, and proactively checked in with us every week while we were getting set up. It finally feels like we have a team that cares about our business as much as I do.

Sean Luangrath

CEO, Inergy

Get a free compliance audit

Chat with a tax expert. Free 30-minute audit—no card required.

FAQs

We charge a flat fee of $75 per filing or registration. No long term contracts. Pay as you go.

Yes, we serve ecommerce brands from early days with tax obligations just in a single state to mature businesses with $10M+ annual sales and dozens of filings per month. We integrate with common ecommerce platforms like Shopify, Square and Amazon.

Yes, we serve a wide range of SaaS companies, B2B and B2C. We integrate with common billing systems like Stripe, and accounting software like QuickBooks and Xero.

Yes, if a filing or registration has not been processed on time, we will pay any penalties or fees you incur.

Sales tax compliance is a legal requirement for businesses operating in jurisdictions where sales tax applies. Failure to comply can result in penalties and fees, which can be costly for businesses. It's important to manage your sales tax obligations to avoid these potential legal and financial consequences.

The states where you need to register to collect sales tax depend on various factors, including the volume of your sales and your physical presence. At Afternoon, we conduct an audit to determine all the states where you have sales tax obligations.

Yes, we will help you with all sales tax registrations. We will prepare all the necessary paperwork and register on your behalf.

We connect to your billing systems and monitor your sales activity across all states in real-time. When you approach nexus thresholds in any state, we'll notify you and help you register before you're required to collect tax.

Our products

Seamlessly integrated financial stack, that handles your bookkeeping, taxes, and compliance.